Climate Action and GHG Management

Climate Action

Compal actively embraces this trend and comprehensively implements climate governance and carbon management mechanisms.

The Company continuously monitors the evolution of international sustainability disclosure standards, has established climate risk and opportunity management mechanisms based on the TCFD framework, and periodically identifies climate impacts and response strategies. With the IFRS Foundation’s release of IFRS S1 and S2 sustainability disclosure standards, Compal refers to ISSB climate disclosure requirements, evaluates the compliance of internal information systems and disclosure mechanisms, and plans to gradually align with Taiwan’s FSC’s regulations and international standards.

Since 2022, Compal has initiated a group-wide greenhouse gas reduction strategy and gradually developed short-, medium-, and long-term decarbonization pathways through actions to realize energy-efficient and low-carbon operations.Compal actively responds to international initiatives and has set Science Based Targets aligned with the 1.5°C scenario, laying a concrete foundation for its path toward net-zero emissions. In 2024, Compal officially joined RE100 and committed to using 100% renewable energy by 2050 to achieve zero-carbon operations. The Company’s decarbonization efforts prioritize “Purchased Goods and Services” and the “Use of Sold Products,” actively addressing Scope 3 emissions and aligning with global trends in product lifecycle decarbonization.

In addition, Compal actively implements natural capital governance and encourages value chain partners to jointly protect biodiversity and forest conservation. We have issued our Biodiversity and No-Deforestation Policy, which applies to all subsidiaries worldwide in which Compal holds a controlling interest of over 50%. This demonstrates the Company's strong commitment to its responsibility in nature conservation.

In 2024, Compal achieved a “Management Level” rating in both the CDP Climate Change and Water Security questionnaires, reflecting continuous improvement and external recognition of its climate and water resource risk management capabilities.

Greenhouse Gas Management

In accordance with the Financial Supervisory Commission’s (FSC) “Sustainable Development Action Plans for TWSE- and TPEx-Listed Companies,” enterprises are required to disclose the results of their greenhouse gas (GHG) inventories and reduction efforts, covering the entities within their consolidated financial statements.

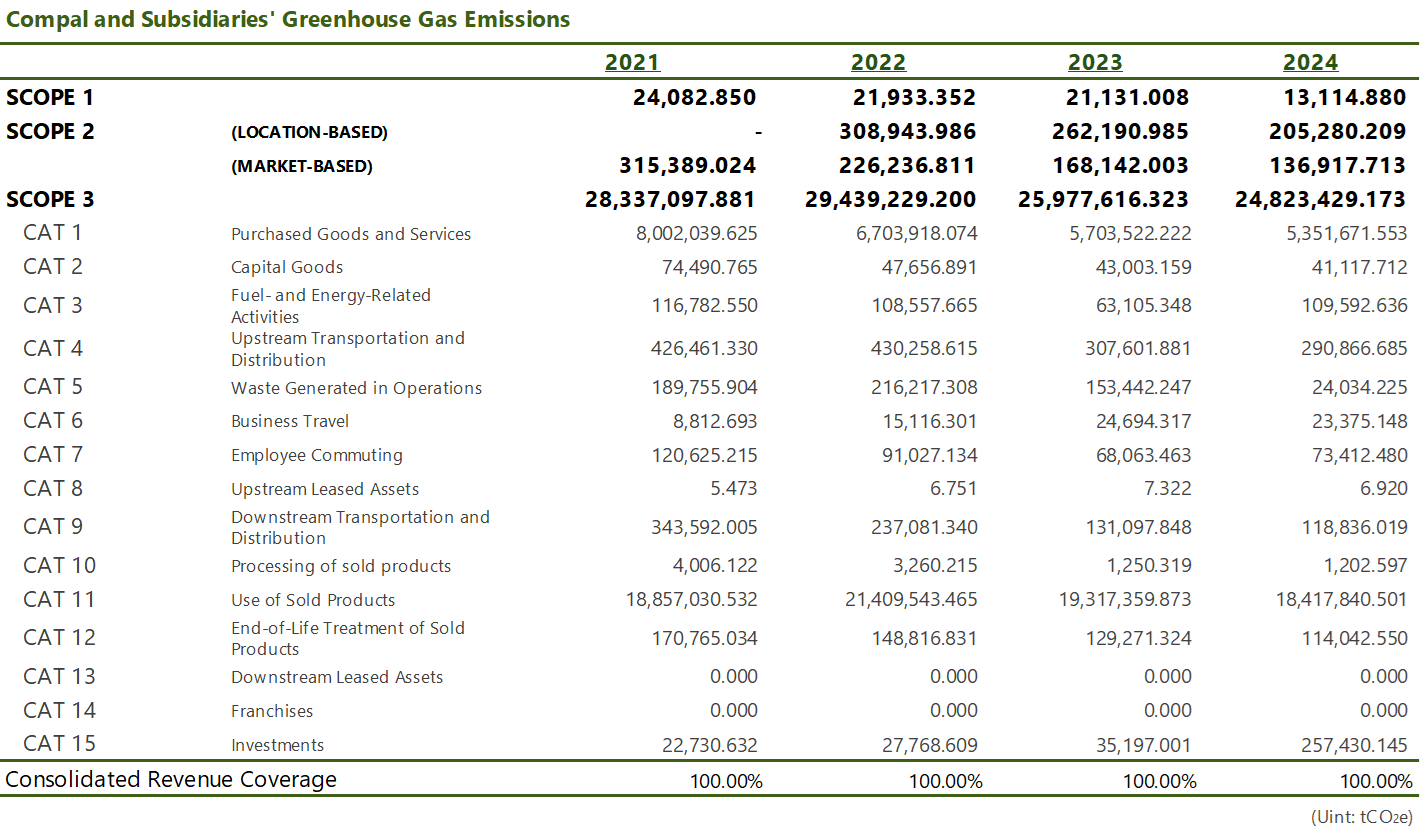

Compal recognizes climate change as a significant challenge to business operations and a core concern for international supply chains. In 2024, Compal completed a comprehensive GHG inventory for all subsidiaries within its consolidated reporting scope, in compliance with ISO 14064-1: 2018. The results were verified by an independent third party, underscoring Compal’s commitment to information transparency and sustainability responsibility.

Goals and Progress

To strengthen internal decision-making and management effectiveness, Compal classifies inventory results into “individual company” and “consolidated reporting scope” categories for emissions monitoring and control. This approach reinforces autonomous carbon management across business units and ensures that all emission targets and actions are traceable and actionable. Furthermore, Compal has set its greenhouse gas reduction targets in alignment with Science Based Targets (SBT), which have been validated by SBTi.

These targets are defined within the boundary of the consolidated financial statements and outline clear short-, medium-, and long-term decarbonization pathways, moving toward the goal of net-zero emissions by 2050.

In consideration of differences in data availability and governance boundaries across emission scopes, Compal has established the following reduction pathways:

- Scope 1 and Scope 2: Baseline year: 2019

o Baseline emissions: 369,033.14 tCO₂e

o Medium-term target (by 2030): 50.68% reduction from the baseline year.

o Long-term target (by 2050): 90% reduction from the baseline year, with residual emissions neutralized through carbon offsets.

o Baseline year: 2021

o Medium-term target (by 2030): 25% reduction

o Long-term target (by 2050): 90% reduction

Compal will continue implementing greenhouse gas reduction projects across internal operations and the value chain, including equipment efficiency improvements, renewable energy adoption, low-carbon procurement promotion, and product carbon footprint assessments, to progressively achieve its RE100 and net-zero emissions goals by 2050.

Greenhouse Inventory

Since 2010, Compal has implemented ISO 14064-1 greenhouse gas inventories with external verifications, thus establishing a comprehensive greenhouse gas management system. To align with the latest international standards and scientific evidence, since 2023, Compal has fully adopted the Global Warming Potential (GWP) values from the IPCC’s Sixth Assessment Report (AR6 WG3) published in 2022. Fuel emission factors are primarily based on the IPCC 2006 Guidelines, along with government-announced energy consumption values for each operating site. Electricity emission factors are calculated using government-announced values for each operating site to enhance data accuracy and comparability.

Per the “GHG Protocol”, Scope 1 includes direct emissions from owned or controlled sources, Scope 2 includes indirect emissions from purchased electricity, and Scope 3 includes other indirect emissions (e.g., supply chain and product use phase).

■ Greenhouse Gas Emissions

For the entity-level reporting boundary, the following Scope 3 categories have been verified:

o Category 1: Purchased goods and services – indirect emissions from the life cycle of operational water use: 379.547 tCO₂e.

o Category 3: Fuel- and energy-related activities: 101,155.099 tCO₂e.

Greenhouse Gas Reduction

In 2024, biogenic CO₂ emissions from biomass combustion amounted to 15.2963 tCO₂e. Compal’s total Scope 1 and Scope 2 emissions, calculated

using the market-based approach, were 107,880.570 tCO₂e, representing a 64.2% reduction compared to the 2019 baseline level of 301,471.351 tCO₂e.

Using the location-based approach, total emissions in 2024 reached 173,709.419 tCO₂e, showing a significantdownward trend, primarily attributable to the following

factors:

o Improved energy efficiency: Increased to 7 ISO 50001-certified sites.

o Expanded renewable electricity procurement:Totaling 130,744.6 MWh.

oEnergy-saving projects and process optimization: See the Energy-Saving Production chapter for details.The nature of the industry means most of Compal’s GHG emissions are concentrated in externally purchased energy.

To reduce GHG emissions in 2024, Compal procured 8,066.9 MWh of photovoltaic energy, 28,251.7 MWh of hydropower, and acquired 94,426 renewable energy certificates (RECs). Compal is there working hard to realize the target of GHG emissions reduction by 2030.

Investment in Energy-Saving Equipment

In 2024, Compal invested a total of NT$3.39 million in energy-saving equipment at the Pingzhen plant in Taiwan. The investment was used to install an air conditioning energy monitoring platform and variable frequency devices to enhance electricity savings and carbon reduction. It is expected to save 316,542 kWh of electricity annually and reduce carbon emissions by 159 tons per year. The details are as follows:

o Energy Management: An investment of NT$2.13 million was made to install an air conditioning energy monitoring platform, which includes multiple digital meters, thermometers, and flow meters. This measure is expected to reduce electricity consumption by 199,740 kWh annually and decrease carbon emissions by 101 tCO2e per year.

o New Energy-Saving Equipment: An investment of NT$1.26 million was made to install variable frequency controllers for the reflow oven exhaust system and the SMT process exhaust system. This measure is expected to save 116,802 kWh of electricity annually and reduce carbon emissions by 58 tCO2e per year.

In 2025, the Company continued to advance energy-saving investments across its sites, combining improvements in management mechanisms with upgrades to key equipment to progressively enhance overall energy efficiency.

In Vietnam, multiple energy-saving measures were completed in 2025, with a primary focus on strengthening energy management mechanisms, optimizing lighting systems, and introducing variable-frequency energy-efficient air-conditioning equipment. Total energy-saving investment expenditure for the year amounted to approximately NTD 14,158 thousand. These measures were completed and put into operation in 2025, forming an important foundation for overseas manufacturing sites to continuously reduce operational energy consumption and strengthen energy management capabilities.

At the Taipei R&D site an energy-saving chiller replacement project has been initiated, with an estimated investment of NTD 9,520 thousand. High-efficiency variable-frequency chillers have been introduced starting in 2025, and the replacement and acceptance process is planned for completion in 2026. Through the replacement of aging, high-energy-consumption equipment, the project is expected to further improve air-conditioning system efficiency and enhance energy performance and operational stability at office facilities.

Overall, the Company is building on the energy-saving investment achievements completed in 2025 and aligned with the planned replacement of key infrastructure replacement in 2026. Through a phased, site-specific energy investment strategy, the Company continues to advance energy management refinement, supporting its medium- to long-term carbon reduction and operational efficiency improvement objectives.

Internal Carbon Pricing, ICP

In response to intensified global climate change and the increasing implementation of carbon fees and trading mechanisms by governments, companies must proactively prepare for future carbon regulations to remain competitive. In 2024, Compal completed the planning of an Internal Carbon Pricing (ICP) mechanism. In its initial phase, a shadow pricing approach was adopted to assess external carbon-related risks and incorporate the concept of implicit price into internal carbon reduction cost evaluations. Based on comprehensive assessment, Compal established an ICP system covering its consolidated financial reporting boundary, the ICP is set between US$13 to $110 per metric tonne CO2e. Going forward, Compal will continue to optimize its ICP mechanism to ensure alignment between carbon management policies and corporate growth objectives, while actively advancing carbon reduction actions to achieve its net-zero emissions target by 2050.